The spherical activated carbon market has good development prospects, and the number of domestic companies is increasing.

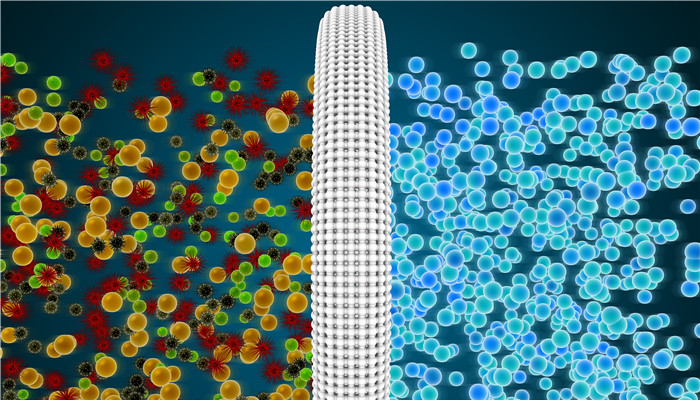

Activated carbon refers to a kind of crystal carbon prepared from carbon-containing raw materials such as wood, coal and petroleum coke through pyrolysis and activation processing. Spherical activated carbon (SAC) refers to activated carbon with a spherical outer shell and a spherical inner core inside the outer shell. Spherical activated carbon has a unique pore structure and good adsorption capacity. It is widely used in sewage treatment, waste gas recovery, clinical medicine, polysilicon production, gas masks and other fields.

According to the “2022-2027 China Spherical Activated Carbon Industry Market In-depth Research and Development Prospects Forecast Report released by the Industrial Research Center, 2020 In 2018, the global spherical activated carbon market sales volume reached 1.4 thousand tons, and the market sales exceeded US$95 million. Against the backdrop of increasingly stringent environmental protection regulations, the spherical activated carbon market has broad room for development. It is expected that the global spherical activated carbon market sales will maintain an average annual compound growth rate of 4.2% from 2022 to 2026.

Globally, Europe, Japan, North America and other regions are the main consumption areas of spherical activated carbon. Water pollution and air pollution caused by the accelerated industrialization process are one of the main factors driving the growth of demand for spherical activated carbon. In recent years, as the industrialization process of emerging economies accelerates, the growth rate of the spherical activated carbon market in India, China and Southeast Asian countries has accelerated. However, compared with ordinary activated carbon, spherical activated carbon is more expensive, which limits its market application to a certain extent.

From the perspective of the industrial chain, the upstream of the spherical activated carbon industry chain is the raw material layer, involving phenolic resin, coal tar, asphalt and other raw materials; the midstream is the spherical activated carbon production layer. According to different raw materials, spherical activated carbon can be divided into resin-based, asphalt-based, coal-based Mass-based and others; the downstream is the application layer. Currently, pollution control, clinical medical use and protective equipment are the main application scenarios of spherical activated carbon.

There are certain technical, financial and channel barriers in the spherical activated carbon industry. Globally, there are few spherical activated carbon suppliers, mainly including Kureha, Acro Chemical Corporation, Kureha Chemical, Blücher GmbH, etc. In recent years, my country’s spherical activated carbon market demand has grown steadily, and the good market prospects have also attracted many companies to enter the market, including Hunan Xiwei New Materials, Henan Longzheng Environmental Protection, Shenzhen Global Greenland New Materials, etc. my country is one of the major suppliers of activated carbon in the world, but domestically produced activated carbon has poor specificity, and its products are mostly concentrated in the mid- to low-end fields. The quality of spherical activated carbon is uneven, and there is broad room for industry improvement in the future.

Industry analysts said that spherical activated carbon has excellent adsorption performance and has a wide range of applications. In recent years, with the increasing environmental protection requirements, spherical activated carbon The demand for activated carbon market continues to be released, and the scale of the industry continues to expand. At present, my country’s spherical activated carbon market is still in the early stages of development. The quality of domestic spherical activated carbon is uneven. There is still a gap between the industry and the international level in terms of production scale, talent training, and technical level.

微信扫一扫打赏

微信扫一扫打赏