The size of my country’s glufosinate ammonium market is gradually growing, and the industry concentration is relatively high

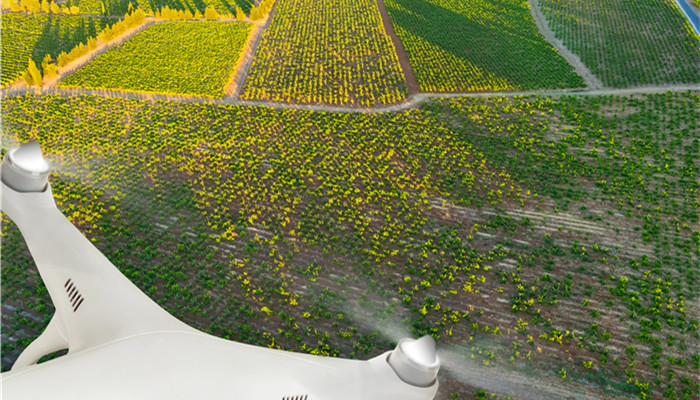

Glufosinate is one of the subdivided products of herbicides. Its main function is to inhibit the activity of glutamine synthetase in plants, blocking glutamine synthesis, thereby interfering with plant metabolism and promoting plant death. Compared with other types of herbicides, glufosinate-ammonium has the advantages of lower toxicity, broad herbicidal spectrum, higher activity, faster weed killing, and easy degradation in soil. It is widely used in no-cultivated land, non-cultivated land, and crops. Weed control in fields and other scenes.

With the gradual advancement of production technology, the industrial production routes of glufosinate-ammonium are gradually increasing, which can be roughly divided into aluminum method-Strecker process, Grignard-Strecker process, thermal cracking-ACA process, etc. Among them, the thermal cracking-ACA process has good production continuity and is friendly to the ecological environment, but the process is difficult and is still in the research and development stage in China; the aluminum method-Strecker process and the Grignard-Strecker process have simple processes and low production costs. etc., but it also has disadvantages such as high pressure on environmental protection and a large amount of solid waste produced. At present, the aluminum method-Strecker process and the Grignard-Strecker process are still the mainstream production processes in China.

According to the “China Glufosinate Ammonium Market Analysis and Development Prospects Research Report 2023-2027” released by the Industrial Research Center, in the country With the support of policies, my country’s planting structure has gradually adjusted, and the total sown area of crops has gradually increased. According to data from the Ministry of Agriculture and Rural Affairs, in 2022, my country’s annual crop sowing area will be 7,161.97 thousand hectares, an increase of 166.06 thousand hectares over the previous year, and a year-on-year increase of 2.4%. As the sown area of crops gradually increases, the demand for herbicides continues to increase. As one of the important products of herbicides, glufosinate-ammonium’s market demand gradually increases. Due to the excellent comprehensive properties of glufosinate and its good compatibility with the ecological environment, its application fields have gradually broadened. It is used in the management of annual, perennial dicotyledonous and gramineous weeds in rapeseed, soybeans, corn, cotton and orchards. Better effect, market demand further increased. Against this background, the size of my country’s glufosinate ammonium market has gradually grown. In 2022, my country’s glufosinate ammonium market size will be 2.39 billion yuan.

Industry analysts said that at present, my country’s glufosinate market concentration is relatively high, and leading companies have emerged. Foreign glufosinate-ammonium companies mainly include UPL, BASF Chemicals, Leer Chemical, etc.; domestic large-scale glufosinate-ammonium companies mainly include Yangnong Chemical, Xingfa Group, Guangxin Co., Ltd., Yongnong Biotech, Yisheng Chemical, and ADAMA Co., Ltd., Ruikai Chemical, Xin’an Chemical, Weiyuan Biochemical, etc. In the early days, due to the late start of domestic enterprises and relatively backward technological level, foreign enterprises occupied most of the market. With the gradual rise of my country’s glufosinate-ammonium enterprises and their continuous increase in R&D investment, the gap between production technology and international advanced technology has gradually narrowed, product quality has gradually improved, and market competitiveness has gradually increased.

微信扫一扫打赏

微信扫一扫打赏