The market space for sodium hexafluorophosphate electrolyte is huge, and the number of companies involved is increasing

There are various technical routes for sodium-ion battery electrolytes, and sodium hexafluorophosphate electrolyte is currently an important solution. Sodium hexafluorophosphate, with the chemical formula NaPF6, appears as a colorless crystalline powder and is easily soluble in water. The sodium hexafluorophosphate electrolyte appears as a colorless, clear and transparent liquid.

Global lithium resource reserves are limited. With the development of the electric vehicle industry, the production cost of lithium-ion batteries continues to increase. It is extremely important to develop battery technology that can be used complementary with lithium-ion batteries. The world has abundant sodium resources. The raw materials for sodium-ion batteries are easy to obtain and the cost is low. Their performance is significantly better than that of lead-acid batteries, so they have attracted market attention. The working principle and structural composition of sodium-ion batteries are the same as those of lithium-ion batteries, and the electrolyte is an important component.

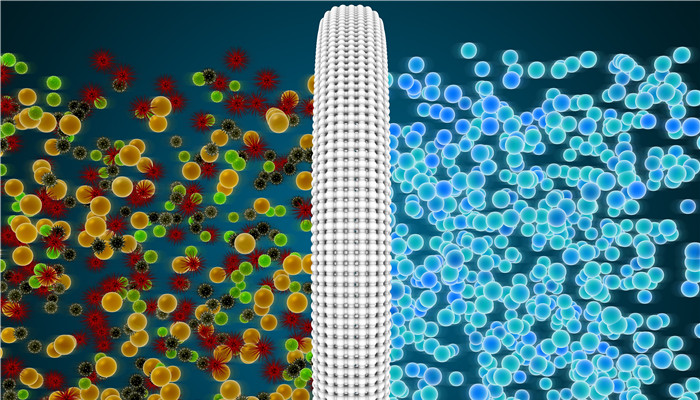

Sodium-ion batteries are mainly composed of positive electrodes, negative electrodes, electrolytes, separators, etc. The electrolyte is an important carrier for sodium ions to move between the positive and negative electrodes to achieve charge and discharge. Its performance directly affects the charge-discharge rate and energy density of sodium-ion batteries. , cycle life and other properties. Sodium-ion battery electrolytes mainly include three categories: liquid, solid, and solid-liquid mixed. The subdivided products have different advantages and disadvantages. Currently, the application proportion of sodium hexafluorophosphate electrolyte is relatively high.

According to the“China Sodium Hexafluorophosphate Electrolyte Industry Market In-depth Research and Development Prospects Forecast Report 2023-2028” released by the Industrial Research CenterIt shows that sodium hexafluorophosphate electrolyte has the advantages of high conductivity, good compatibility with positive and negative electrode materials, high solubility, and low preparation difficulty. The production process, production technology, production equipment, etc. of sodium hexafluorophosphate electrolyte are basically the same as that of lithium ion battery electrolyte lithium hexafluorophosphate (LiPF6), except that sodium salt is used instead of lithium salt. It is highly compatible with the lithium battery electrolyte production line and is easy to implement. mass production.

Since the lithium hexafluorophosphate production line is easy to convert to the sodium hexafluorophosphate production line, in my country, most of the companies entering the sodium hexafluorophosphate electrolyte market are lithium-ion battery electrolyte companies. At this stage, the main manufacturers of sodium hexafluorophosphate electrolyte in my country are Dufluoro, Tianci Materials, Xinzhoubang, Fengshan Quannuo, Sodium Innovation Energy, Zhongxin Fluorine Materials, etc. Among them, Duofuoduo is the first company in my country with the mass production capacity of sodium hexafluorophosphate electrolyte.

my country is a major producer of lithium-ion batteries in the world. It has sufficient production capacity for lithium-ion battery electrolyte, and the production scale of sodium hexafluorophosphate electrolyte is expected to expand rapidly. However, sodium hexafluorophosphate electrolyte also has some shortcomings, such as easy decomposition, easy hydrolysis, and poor thermal stability, which will lead to a decrease in sodium ion conduction efficiency, thereby affecting the performance of sodium ion batteries. At present, adding additives, such as fluoroethylene carbonate (FEC), is usually used to improve the performance of sodium hexafluorophosphate electrolyte.

Industry analysts people said that in 2023, my country’s sodium-ion battery pilot lines and mass production lines are expected to be launched one after another, and the industry is about to plan Entering the outbreak period, it is expected that my country’s demand for sodium-ion batteries will reach 200GWh by 2025. Against this background, the market space for sodium hexafluorophosphate electrolyte is large. In comparison, companies with technical and cost advantages in the field of lithium-ion battery electrolyte are more competitive in the sodium hexafluorophosphate electrolyte market and are expected to continue Maintain a competitive advantage.

微信扫一扫打赏

微信扫一扫打赏